Besondere Wünsche

Besondere Wünsche

Videoberatung

Videoberatung

Besondere Wünsche

Besondere Wünsche

Specific requirements

Specific requirements

Specific requirements

Specific requirements

Factoring Basics

Legal Basics: German Banking Act §§ 13-19, 21 / German Civil Code §§ 433 ff

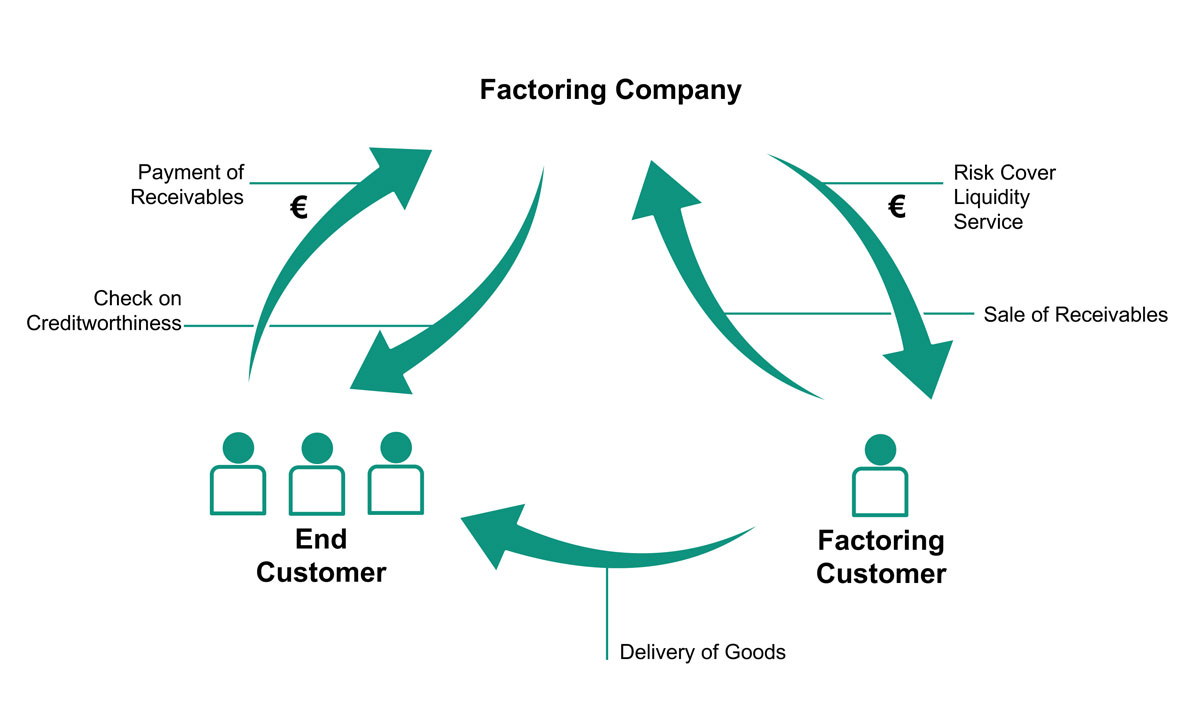

Functions of Non-Recourse Factoring

- Financing:

The factoring company advances the receivables immediately up to 90 % of the invoice value.

- Del Credere Cover:

The factoring company reviews the credit rating of the clients and assumes the credit risk within client limits.

- Debtor Management:

Upon request, the factoring company manages the accounts receivable and takes over the dunning and collection procedure.

How does Factoring Function?

Factoring Variations

| Full-Service | Smart-Service | Inhouse | |

|---|---|---|---|

| Product Characteristics | |||

| Immediate liquidity (up to 90 % of the invoice value) | ✓ | ✓ | ✓ |

| Acceptance of 100 % of del credere risk | ✓ | ✓ | ✓ |

| Debtor Management | ✓ | ✓ | — |

| Dunning and Collection | ✓ | collection | collection |

| Type of Factoring | |||

| Open Factoring | ✓ | ✓ | ✓ |

| Tacit Factoring | — | ✓ | ✓ |

| Target Customers | |||

| Capacity of the accounting department | low | medium | good |

| IT infrastructure | low | good | good |

| Turnover (normally) | up to 20 mio. € | up to 20 mio. € | minimum of 10 mio. € |

| Number of invoices | medium | medium | high |

| Dunning and Collection | optimization required | established dunning | high number of positions |

Which Advantages does Factoring Offer?

Optimizing your Working Capital

- Corporate expansion due to immediately available liquidity instead of a high level of outstanding accounts

- Financing on the basis of accounts receivable

- Evaluating up to 90 % of the gross amount invoiced

- Same day availability from invoices submitted to the factoring company

- Financing matched to turnover, even with fluctuations in raw material prices

- Flexible retrieval of liquidity

- Opportunities for opening up foreign markets

- Using cash discount, rebate and bonus options

Minimizing Bad Debts

- The factoring company takes over the buyer’s risk of receivables up to 100 %

- Close review and proof of information on debtors

- Fast check on creditworthiness of new end users

- Permanent risk monitoring by the factoring company

Improving Key Indicators of the Balance Sheet

- True sale of accounts receivable

- Improving the equity ratio

- Improving the overall value of the corporation

- Optimizing the cashflow

- Retrieval of liquidity is possible on defined effective dates

![]()